Car accidents can be stressful and confusing all at once, especially when you’re driving a leased vehicle. In the event of a collision, you might find yourself wondering, “What happens if you total a leased car?” This comprehensive guide will shed light on the steps you need to take, the role of insurance companies, and your rights and responsibilities if you find yourself in such a predicament in Nevada.

Understanding the Basics: Totaling a Leased Car

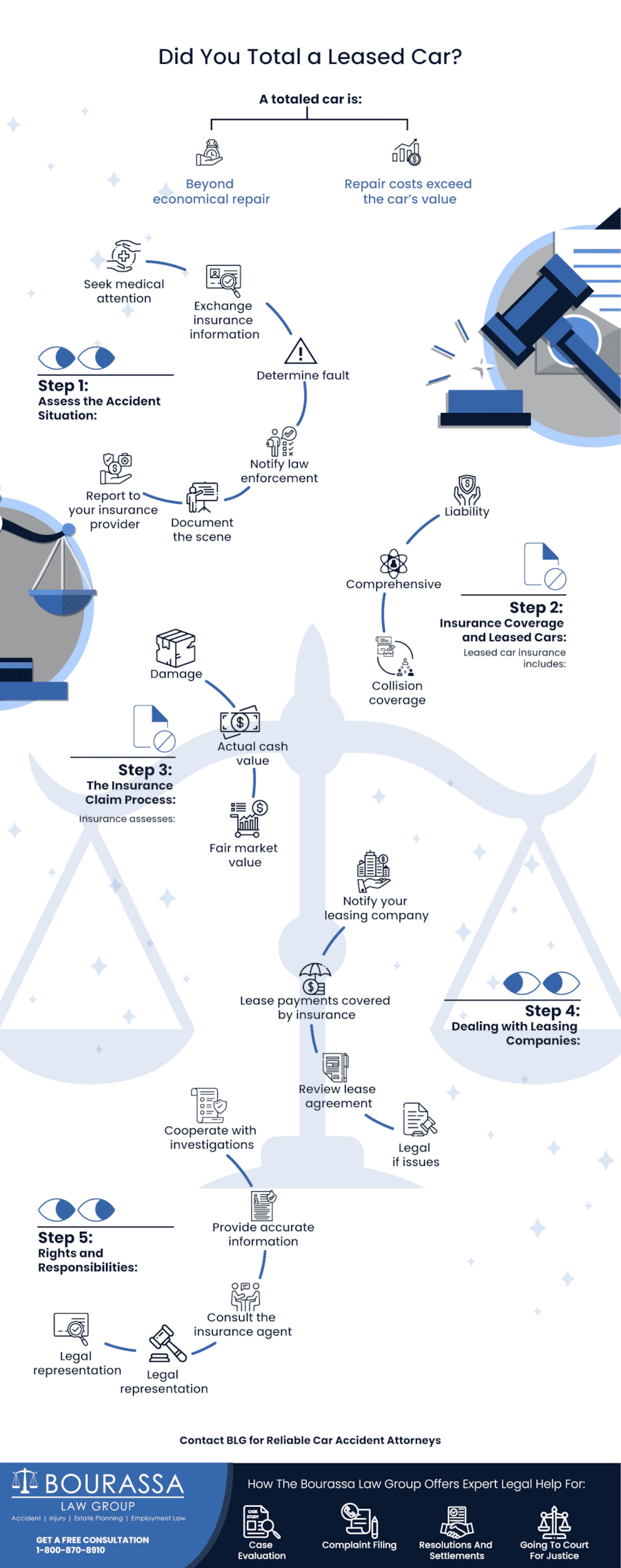

Before delving into the specifics, it’s crucial to understand what it means to “total” a leased car. When we say a car is “totaled,” it means that the cost of repairing the vehicle exceeds its value or it’s beyond the point of safe and economical repair. In such cases, the vehicle is deemed a total loss.

Step 1: Assess the Situation at the Accident Scene

In the aftermath of a car crash, it’s essential to prioritize safety and well-being. Seek medical attention and ensure other individuals involved also get help. Once you’ve addressed immediate concerns, here are some crucial steps to follow:

Exchange Contact Information: Regardless of who’s at fault, exchange contact and insurance information with the other driver(s) involved.

Determine Fault: Establishing fault is a pivotal factor in determining how the process unfolds. Nevada follows a “comparative negligence” system, meaning each party’s degree of fault can impact the outcome.

Seek Legal Counsel: If you’re in doubt about liability, consider consulting a car accident attorney who can provide guidance based on the specifics of your case.

Notify Law Enforcement: In the event of an accident causing injuries, fatalities, or significant property damage, report it to the police. An accident report can be instrumental later on.

Document the Accident Scene: Take photos and video of the accident scene, vehicle damage, license plates, and any visible injuries. This documentation may be valuable during the insurance claim process.

Notify Your Insurance Provider: Promptly inform your auto insurance company about the accident. This is essential, even if you weren’t at fault, as it initiates the claims process.

Step 2: Insurance Coverage and Leased Cars

Your insurance coverage plays a pivotal role in the aftermath of a car accident. Here are some key terms and concepts to be aware of:

Leased Car Insurance:

If you’re leasing a vehicle, you likely have specific auto insurance coverage. This should include liability coverage, which is mandatory in Nevada, as well as comprehensive and collision coverage. These types of coverage can be vital when your leased vehicle is involved in an accident.

Gap Insurance:

If you haven’t already purchased gap insurance, now is a good time to understand its importance. Gap coverage covers the “gap” between your leased car’s actual cash value and the remaining balance on your lease contract. In other words, it helps you avoid paying out of pocket if your leased car is totaled.

Liability Insurance:

In Nevada, the minimum liability coverage requirements are $25,000 for bodily injury or death of one person, $50,000 for bodily injury or death of two or more persons, and $20,000 for property damage. This coverage is essential for covering damages you may cause to others in an automobile accident where you are at fault.

Step 3: The Insurance Claim Process

Once you’ve reported the accident to your car insurance company, they will guide you through the claims process. It’s important to cooperate fully and provide any requested information. The following are the key steps:

Assessment of Damages:

Your insurance provider will assess the extent of damages to your leased vehicle. This will include evaluating the car’s fair market value and repair costs. In the case of a totaled car, the focus shifts to determining the actual cash value.

Actual Cash Value vs. Fair Market Value:

These terms might seem similar, but they have distinct meanings. The actual cash value is the value of your car just before the accident, while the fair market value is the price your vehicle would fetch on the open market. Insurance companies typically use these values to determine compensation.

Repair Shop Selection:

In cases of non-total losses, your insurance company might recommend approved repair shops or allow you to choose your own. The repair process will be coordinated by the shop, and the costs will be covered by your insurance, minus any applicable deductibles.

Compensation and Payment:

If your leased car is totaled, your insurance company will compensate you based on its assessment of the actual cash value. The payment can be used to settle your lease agreement and potentially leave you with funds to put towards a new car.

Step 4: Dealing with Leasing Companies

Your leasing company also has a significant role to play in the event of a totaled leased car. Here’s how to navigate this aspect:

Notify Your Leasing Company:

Once your insurance provider has determined that your car is a total loss, inform your leasing company of the situation. They need to be aware of the accident and the impending settlement.

Lease Payments:

Typically, the remaining lease payments will be covered by your insurance settlement. However, if there is a gap between the settlement amount and the remaining balance, gap insurance should cover it.

Lease Agreement:

Review your lease agreement carefully, especially the section pertaining to accidents and insurance. It should outline the procedures to follow in case of a totaled leased vehicle.

Legal Representation:

If you encounter any difficulties in your interactions with the leasing company, consider seeking legal representation. An experienced car accident lawyer who has dealt with lease agreements before can advocate on your behalf.

Step 5: Rights and Responsibilities

Understanding your rights and responsibilities in the aftermath of a car accident involving a leased vehicle is crucial. Here’s what you should be aware of:

Cooperate with Investigations: You have a responsibility to cooperate with law enforcement investigations, insurance claims, and any other relevant inquiries.

Insurance Information: Provide accurate and complete information to your insurance company. Failure to do so can lead to complications or even the denial of your claim.

Medical Bills and Lost Wages: If you’ve sustained injuries in the accident, your auto insurance might cover medical expenses and lost wages, depending on your policy. Consult with your insurance agent to understand the extent of your coverage.

Legal Representation: If the accident was caused by another party and you’re seeking compensation for bodily injury, property damage, or other losses, it’s advisable to consult a car accident lawyer. They can help you navigate the legal aspects and negotiate with the at-fault driver’s insurance company.

Lease Contract Review: Carefully review your lease contract for any clauses related to accidents and insurance. Understanding the terms and conditions can help you navigate the situation more effectively.

The Bourassa Law Group Has Your Back in All Car Accident-Related Matters

Car accidents are unfortunate events that can become even more complex when you’re driving a leased vehicle. If your leased car is totaled, follow the steps discussed in this article. Knowing your rights and responsibilities in these situations is equally important.

While the process may seem daunting, it’s important to remember that you’re not alone. Car accident lawyers, insurance agents, and leasing companies are there to assist you in the aftermath of such incidents. Whether you need legal representation, guidance on your lease contract, or advice on navigating the insurance process, these resources can help you through the challenges that come with totaling a leased car.

The Bourassa Law Group has a team of talented car accident attorneys to guide you through the legal procedures. We assess your case and suggest the best course of action to resolve your issues.

Need us to evaluate your case? Give us a call at 1-800-870-8910 to schedule a free consultation.