In the aftermath of a car accident, the weight of the situation can be overwhelming. Insurance coverage becomes pivotal amid concerns about injuries, repairs, and medical expenses. One common type of insurance many individuals rely on is liability insurance. While it is designed to provide financial protection, it’s essential to grasp the nuances of what liability insurance does not cover in the event of an accident.

What is Liability Insurance?

Before delving into the exclusions, let’s briefly understand what liability insurance entails. In the context of auto insurance, liability coverage comes in two primary forms: bodily injury liability and property damage liability.

Bodily Injury Liability Coverage: This liability insurance helps cover the costs associated with injuries to others in an accident for which you are deemed at fault. It typically includes medical expenses, lost wages, and legal fees.

Property Damage Liability Coverage: This aspect steps in when your vehicle causes damage to another person’s property. It encompasses the repair or replacement costs of the damaged property, be it another vehicle, a fence, or any other structure.

What Liability Insurance Does Cover?

While liability insurance is an essential component of auto insurance policies, it’s crucial to understand what it does cover. In the event of an accident, liability insurance can help pay for the injured party’s medical costs, property damage coverage, and financial protection in case legal fees arise.

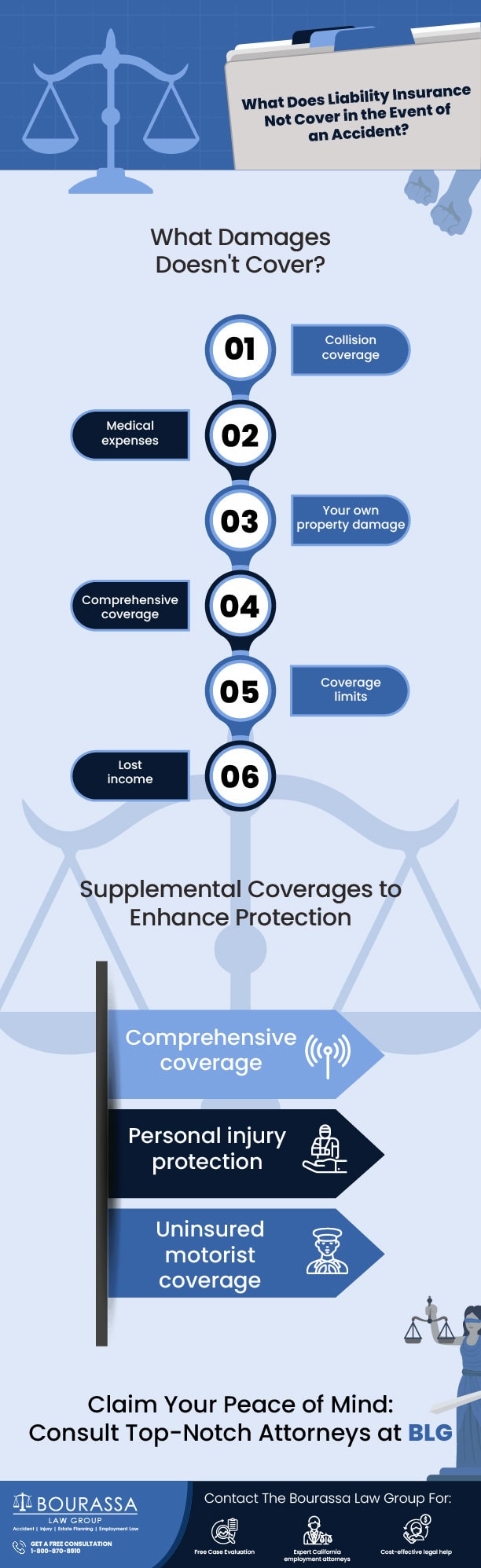

What Liability Insurance Doesn’t Cover?

Despite its importance, auto liability insurance coverage does have limitations. Understanding these limitations is vital for individuals seeking comprehensive protection after an accident. Here are key areas where liability car insurance falls short:

Collision Coverage:

Liability insurance does not cover the repair or replacement costs of your car in the event of a collision. If you are at fault for the accident, you would need additional collision coverage to address the damages to your vehicle.

Medical Expenses

While bodily injury liability coverage helps to cover the medical expenses of others, it does not cover your injuries. You may need to rely on your health insurance or consider additional coverage options for personal medical costs.

Property Damage to Your Property

Property damage liability coverage extends only to damage caused to others’ property. If your vehicle sustains damage in an accident, the costs for repairing or replacing your property are not covered by liability insurance.

Comprehensive Coverage

Liability insurance primarily focuses on accidents and collisions, leaving out coverage for non-collision events like theft, vandalism, or natural disasters. To protect against such scenarios, individuals may need to invest in comprehensive coverage.

Coverage Limits

Liability insurance comes with coverage limits, meaning there is a maximum amount the insurance company will pay. If the costs of the accident exceed these limits, you may be personally responsible for the remaining expenses.

Lost Income and Other Types of Damages

Liability insurance generally does not cover lost income from injuries sustained in an accident. It also does not compensate for other damages, such as pain and suffering.

Is An Auto Insurance Policy a Legal Contract?

A car insurance policy is a binding legal contract between the insured and the insurance company. When you purchase liability insurance, you enter into an agreement that outlines the terms and conditions of coverage. Understanding the intricacies of this contract is crucial, especially when it comes to knowing what liability insurance won’t cover.

Supplemental Coverages to Enhance Protection

Now that we’ve illuminated what liability insurance doesn’t cover, it’s crucial to explore supplemental coverages that can enhance your protection in the event of an accident:

Comprehensive Coverage:

This coverage extends beyond accidents, addressing damages caused by theft, vandalism, or natural disasters. It provides a comprehensive shield for your vehicle.

Personal Injury Protection (PIP):

Personal injury protection (PIP) covers medical expenses for you and your passengers, irrespective of fault. It’s particularly beneficial for addressing injuries resulting from an accident.

Uninsured/Underinsured Motorist Coverage:

In cases where the at-fault party lacks insurance or has insufficient coverage, this type of coverage ensures you’re not left shouldering the financial burden.

How Can an Attorney Help?

Navigating the complexities of insurance coverage and understanding the gaps can be challenging, especially when dealing with the aftermath of an accident. This is where the expertise of a skilled attorney becomes invaluable.

Maximizing Insurance Payouts: An attorney can help ensure you receive the maximum payout from the liable party’s insurance. They understand insurance companies’ tactics to minimize payouts and can negotiate on your behalf.

Pursuing Additional Compensation: In cases where liability insurance falls short, an attorney can help you explore avenues for additional compensation. This may involve filing a lawsuit against the at-fault party to cover costs not addressed by insurance.

Clarifying Legal Options: Understanding your legal options is crucial after an accident. An attorney can assess the specifics of your case, explain what liability insurance covers, and guide you on the best course of action based on your unique circumstances.

Dealing with Insurance Companies: Insurance companies can be formidable adversaries. An attorney acts as your advocate, handling communications with insurance companies, ensuring your rights are protected, and preventing you from being taken advantage of during the claims process.

Claim Your Peace of Mind: Consult Top-Notch Attorneys at BLG

In the aftermath of a car accident, understanding the intricacies of liability insurance is paramount. While this coverage offers vital financial protection, it’s equally crucial to grasp its limitations. Knowing what liability insurance won’t cover empowers you to make informed decisions about additional coverage and take the necessary steps to protect your interests.

If you find yourself in a situation where liability insurance falls short, seeking legal guidance becomes imperative. A knowledgeable attorney can assess your case, explore options for compensation, and guide you through the complexities of the legal process. Remember, being well-informed is your greatest asset in navigating the aftermath of an accident and ensuring that you receive fair compensation for damages.

Navigating the legal landscape after an accident requires expertise and precision. The seasoned attorneys at BLG are here to guide you through the complexities, ensuring you get the compensation you deserve. Don’t let uncertainties linger; secure your peace of mind now. Contact BLG, where your journey to justice begins.

Contact us today for a free consultation.

FAQs

What does liability coverage not protect against?

Liability coverage typically does not protect against damage to your property. It is designed to cover the costs associated with injuries or property damage that you, as the policyholder, are legally responsible for causing to others. It does not provide coverage for your injuries or damage to your property.

What is the limit of liability to insurance coverage?

The limit of liability in insurance coverage refers to the maximum amount that the insurance company will pay for covered losses in a specific policy period. This limit is often expressed as two amounts, such as “per occurrence” and “aggregate” limits. The “per occurrence” limit is the maximum amount the insurer will pay for a single claim, while the “aggregate” limit is the total amount the insurer will pay for all claims during the policy period.

What is the basic difference between liability insurance and collision insurance?

Liability insurance and collision insurance serve different purposes. Liability insurance covers the costs associated with injuries or property damage that you, as the policyholder, are legally responsible for causing to others. It does not cover your injuries or damage to your property.

Collision insurance, on the other hand, specifically covers damage to your vehicle that occurs as a result of a collision with another object, such as another vehicle or a stationary object. It helps pay for the repairs or replacement of your car, regardless of who is at fault in the accident. Unlike liability insurance, collision insurance focuses on your property rather than liability for others.