When employees think about employment disputes, or violation of California employment law, many times they think of things like sexual harassment or employment discrimination, or wrongful termination. However, misclassification of someone who is an employee as an independent contractor has, and continues to be, a widespread issue in California as its employment landscape evolves rapidly. However, both federal law and California employment laws exist to protect misclassified employees and hold employers accountable.

Is your classification clear to you, or are you misclassified as an independent contractor under applicable federal or California employment law? Learn more in this article and explore whether you have an employment claim and the different options you have to seek justice with an employment law attorney if you have been misclassified by your employer.

Understanding Employee Misclassification

Employee misclassification occurs when employers wrongly classify workers as independent contractors rather than employees under California and/or Federal law. While it may seem like a mere technicality, the implications of being misclassified as an independent contractor are profound.

Employers often deliberately misclassify employees as independent contractors to avoid workers compensation liability, payroll taxes, and even to commit wage theft by avoiding minimum wage, and other important benefits of employment. Hence, this unlawful conduct can be considered fraud and can be reported to the Internal Revenue Service (IRS).

You can seek a reliable California employment law attorney to determine whether you are improperly classified as an independent contractor and, if so, help you understand your legal rights and legal options under Federal and California laws.

Legal Framework in California to Protect Employees Against Misclassification

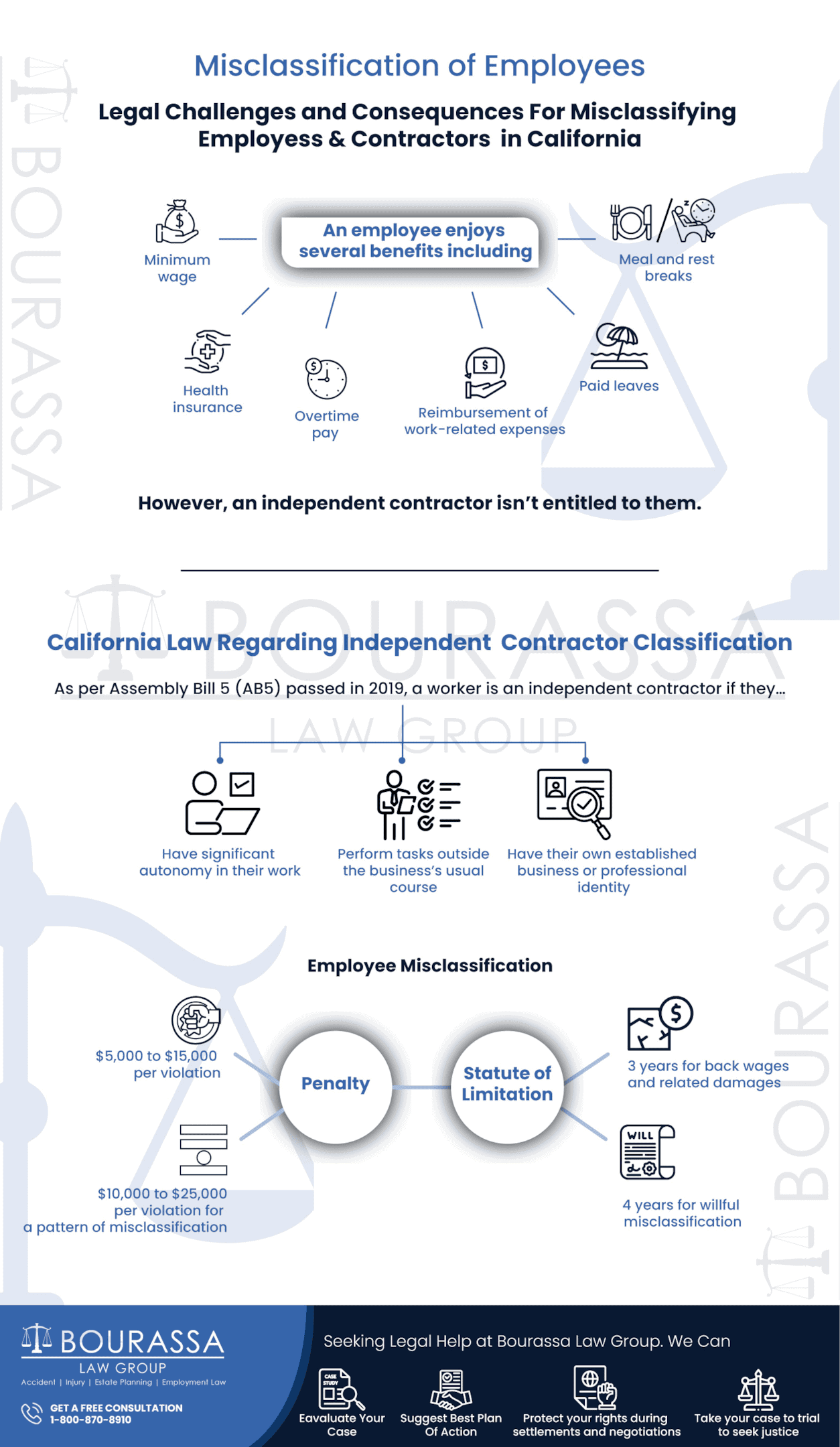

Federal law, including the Fair Labor Standards Act (FLSA), as well as California labor law safeguard workers’ rights, encourage fair employment, and prevent employee misclassification. Whether an employee is misclassified under California law, notably the “ABC test.”

Assembly Bill 5 (AB 5) in 2019 introduced this test, which was further refined by Proposition 22 in 2020. Moreover, it sets a high standard for classifying a worker as an independent contractor.

The ABC test consists of three key criteria. It presumes a worker is an employee, and not an independent contractor, unless the employer can unequivocally demonstrate compliance with all three criteria.

A: Control and Direction:

Under the first criterion, the hiring entity must establish that the worker they claim is an independent contractor operates with a high degree of independence. It means the worker should be free from the control and direction of the employer concerning the performance of their duties.

In practice, it implies that the employer cannot micromanage or exert substantial control over how the worker carries out their tasks. Hence, this criterion ensures that a true independent contractor has significant autonomy in their work.

B: Work Outside the Usual Course of Business:

The second element requires that the worker classified as an independent contractor perform tasks outside the usual course of the hiring entity’s business. This condition challenges businesses relying on contractors to perform core functions.

For instance, a ridesharing company’s primary business is providing transportation. Such companies may find it difficult to argue that a driver is not an employee but is instead an independent contractor. That’s because their core service is reliant on these drivers.

C: Independently Established Trade or Business:

The final component mandates that, to be considered an independent contractor, the worker must be customarily engaged in an independently established trade, occupation, or business. Furthermore, the nature of the work performed should be the same as for the hiring entity.

In simpler terms, this criterion assesses whether the worker has their own established business or separate professional identity. A successful demonstration of this element typically requires the worker to have other clients or customers.

Additionally, to be a true independent contractor, they must operate as an independent entity in their field.

California law is strict when it comes to independent contractors, and meeting all three criteria is indeed a formidable challenge for most businesses, whether they are large employers or small businesses. The stringent nature of the ABC test reflects California’s commitment to protecting workers from being misclassified. It ensures that they receive the rights and benefits associated with employee status under federal law as well as California employment law.

What Is the Penalty for Misclassification of Employees in California?

Penalties for misclassification in California can range from $5,000 to $15,000 per violation. Moreover, these penalties can reach up to $25,000 per violation for a pattern or practice of misclassification. The Labor and Workforce Development Agency or a court determines these penalties.

Here are some other remedies available for employees that an employer may be required to pay under applicable California employment law:

Back Pay and Benefits: Employers who misclassify workers may be required to pay back lost wages and benefits owed to the misclassified employees. It includes unpaid minimum wages, overtime pay, meal and rest break premiums, and any other benefits to which employees would have been entitled had they been classified correctly.

Unemployment and Workers’ Compensation Costs: Misclassified workers who should have been classified as employees may be entitled to unemployment insurance and workers’ compensation benefits. Employers may be responsible for paying the associated costs and premiums, which can be significant.

Tax Penalties: Misclassification can lead to tax-related penalties and liabilities. Employers may be required to pay employment taxes, including Social Security and Medicare taxes, that were not withheld or paid on behalf of misclassified workers.

Liquidated Damages: In some cases, misclassified employees may be legally entitled to liquidated damages, which can amount to an additional sum equal to the unpaid wages and benefits.

Interest and Attorneys’ Fees: Employers found to have misclassified workers may also be responsible for paying interest on back wages and the attorneys’ fees of the misclassified workers if they prevail in a legal dispute.

What Is the Statute of Limitations for Employee Misclassification in California?

The statute of limitations for pursuing legal action related to independent contractor misclassification in California can vary depending on the specific claims involved. Generally, there are two primary statutes of limitations to consider: three years and four years:

Three Years: Under California labor law, the statute of limitations for most wage and hour claims, including those related to misclassification as an independent contractor, is typically three years from the date the violation occurred. It means that an employee has up to three years to file a claim seeking unpaid wages and related damages.

Four Years: In cases where the misclassification is alleged to be willful, the statute of limitations may be extended to four years. Willful misclassification involves knowingly and intentionally misclassifying a worker as an independent contractor when they should have been classified as an employee under California employment law.

Legal Challenges for Misclassified Employees

Employee misclassification opens Pandora’s box of legal challenges for workers. It thrusts them into a problematic realm where their rights and financial security are at stake.

Here, we delve deeper into the multifaceted legal challenges faced by misclassified employees in California:

Minimum Wage Violations:

California’s state and local laws regarding minimum wage are stringent, and they extend protection to all properly classified employees. However, if you are an independent contractor, you fall outside the purview of these protections.

For misclassified employees, it means they may find themselves earning wages below the legally mandated minimum wage under California law. Hence, this situation is a clear violation of their fundamental rights.

Overtime Pay:

The California labor law dictates that non-exempt employees must receive overtime pay when working beyond specific hours. Misclassifying employees as independent contractors, and therefore exempt from overtime pay, violates these labor laws.

Thus, misclassified employees may toil away beyond the standard workweek without reaping the financial rewards they deserve and are entitled to under California laws. It can result in significant financial losses, especially when overtime work becomes a regular part of their job.

Consequently, the so-called independent contractor can’t meet basic needs or invest in their future.

Lack of Benefits:

One of the differences between an employee and an independent contractor is the important benefits employers provide to employees. While employees enjoy benefits like health insurance, unemployment insurance, paid leave, and retirement plans, an independent contractor does not. An employee injured on the job is covered by workers compensation and entitled to medical treatment; an independent contractor is not. Likewise, laws relating to workplace discrimination or workplace harassment apply to employees.

Misclassification thrusts employees into a situation where they are unfairly denied these essential benefits. The absence of these benefits can create a precarious financial situation.

Moreover, it harms the overall well-being of misclassified employees.

Missed Meal and Rest Breaks:

California labor laws take employee rights and worker well-being seriously, mandating specific meal and rest break requirements for employees. However, misclassified employees often don’t get these legally required breaks.

Without adequate breaks, employees may experience fatigue and decreased productivity. It affects their job performance and overall health and well-being.

Hence, the denial of these breaks adds to the challenges misclassified employees face.

Unreimbursed Expenses:

An independent contractor shoulders the responsibility for their own work-related expenses, a fundamental distinction from employees. Misclassified employees may incur costs related to their job, only to discover that they are not entitled to reimbursement from their employers.

This financial burden diminishes the income an independent contractor rightfully earns. Moreover, it forces employees to shoulder expenses that employers should bear.

Thus, it creates a financial strain with lasting repercussions on their financial stability.

California employment lawyers can tackle any employment law case. An experience law firm knows how to pursue an employment lawsuit and seek justice for their clients. Hence, contact a reliable employment lawyer whenever facing an employment law issue.

How to Seek Legal Action Against Your Employer for Misclassification

Facing the daunting challenge of being misclassified as an employee in California? Understanding how to seek legal action against your employer is crucial.

Here, we outline the steps you can take to assert your rights under California employment law and pursue economic justice:

Consult a California Employment Law Attorney:

Seek out an experienced California employment law attorney who specializes in labor law and employee misclassification cases. An employment lawyer will well-versed in California employment law and federal law such as the Fair Labor Standards Act can assess the specifics of your situation and provide expert guidance on the best course of action. Competent legal representation can be your advocate throughout the legal process.

Document Your Case:

Collect and organize all relevant documentation. It includes pay stubs, employment contracts, work-related emails, records of hours worked, and any communication with your employer regarding your classification.

These documents serve as essential evidence for employment law cases, and can dramatically help your employment lawyer present your case.

File a Complaint:

If you believe that California labor law has been violated, you have the option to file a complaint with the California Department of Industrial Relations, Division of Labor Standards Enforcement (DLSE). They can investigate your case and, if necessary, take enforcement action against your employer.

Engage in Mediation or Settlement:

In some instances, misclassification issues can be resolved through mediation or negotiated settlements. Your employment law attorney can facilitate these discussions to reach a mutually agreeable resolution.

Be Prepared for Legal Proceedings:

If your case proceeds to either state of federal court, be prepared to provide testimony and evidence to support your claims. Your California employment law attorney will guide you through the legal process, ensuring you are well-prepared for any hearings or trials. Choose a law firm with employment attorneys willing to work hard and seek justice for your rights under California employment law.

Contact the Best California Employment Attorney at Bourassa Law Group

Independent contractor misclassification is a horrible yet prevalent reality in today’s California employment landscape. However, California labor law has various safeguards to protect eligible employees against harm. To preserve your important rights, you should contact an employment attorney for an initial consultation to help to ensure your rights as an employee.

At Bourassa Law Group, a California law firm, our experienced California employment attorneys can help you seek justice. Our law firm believes that your rights as an employee deserve to be protected, and our employment attorneys are here to offer you guidance throughout.

Employment law matters! Take action to get your deserved compensation. Contact us for a free consultation today!

The Bourassa Law Group

9440 Santa Monica Blvd #301

Beverly Hills CA 90210

DO YOU FEEL YOU HAVE BEEN MISCLASSIFIED AS A CONTRACTOR?

Being misclassified as a contractor robs you of many essential employee rights. At BLG, we understand the frustration this can cause and can assist you in rectifying this misclassification. We’ll work diligently to ensure your employee rights are upheld so you receive the benefits you deserve.

Call 303-331-6186

Contact Us