Car accidents can be traumatic experiences, both physically and emotionally. In the aftermath of a collision, one of the pressing concerns is often the financial implications and the potential impact on personal assets. If you find yourself in the unfortunate situation of being the at-fault party in a car accident, you might wonder, “Can I lose my house due to an at-fault car accident?” In this article, we’ll delve into the intricacies of liability coverage, insurance companies, and the steps you can take to protect your assets in Nevada.

Liability Coverage and Insurance Company: Understanding the Basics

Liability coverage is crucial to auto insurance, especially in at-fault car accidents. This coverage protects you financially if you’re responsible for injuring others or damaging their property in a car accident. In Nevada, as in many other states, liability insurance is a legal requirement for all drivers.

However, liability insurance coverage has its limits. It typically includes two components:

Bodily Injury Coverage: This aspect covers the medical expenses, rehabilitation, and sometimes lost wages for the other party involved in the accident.

Property Damage Coverage: This covers the repair or replacement costs for the other party’s vehicle or any other property damaged in the accident.

While liability coverage is mandatory, the minimum requirements may sometimes be sufficient to cover the costs of a severe accident. This raises the question: Is liability coverage enough to cover an auto accident, or could you still be at risk of losing personal assets like your house?

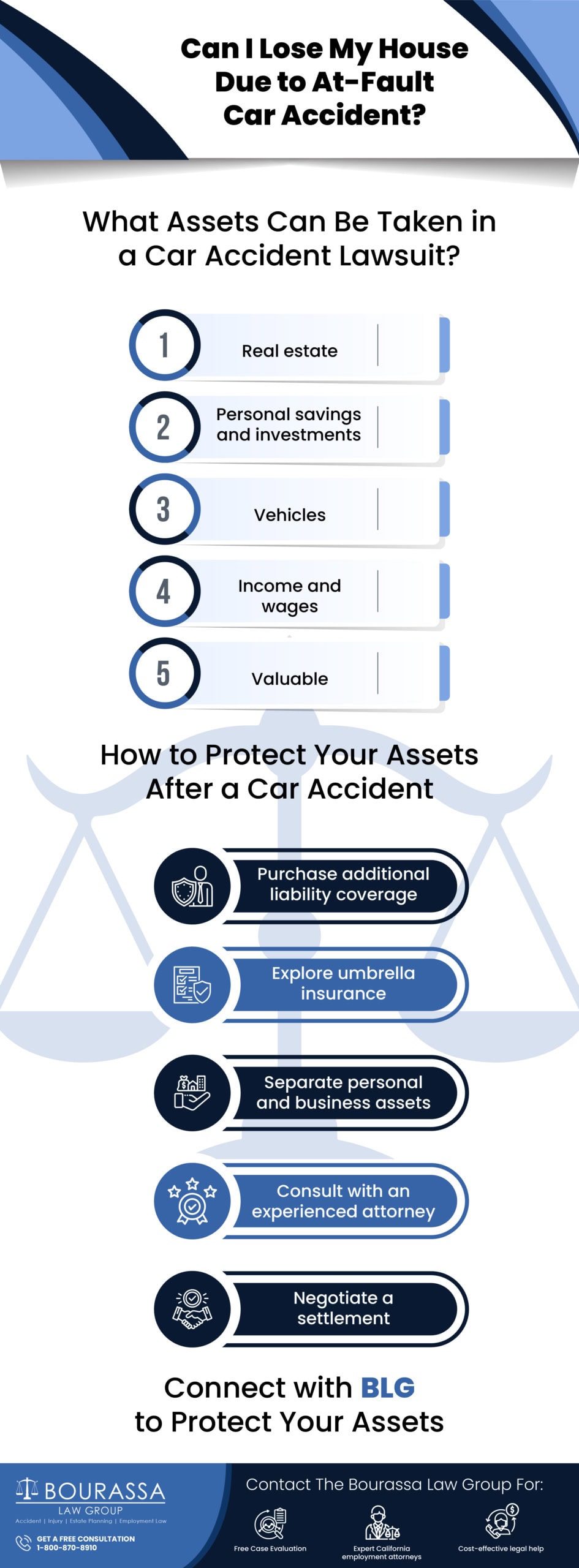

What Assets Can Be Taken in a Car Accident Lawsuit?

In the event of car accident lawsuits, your assets could be at stake significantly if the damages exceed your liability coverage limits. While the specific laws regarding asset seizure can vary, there are common assets that could be targeted:

Real Estate: This includes your home, which is often the most significant asset for many individuals.

Personal Savings and Investments: Bank accounts, stocks, and other investments may be subject to seizure.

Vehicles: Beyond the one involved in the accident, other vehicles registered in your name could be targeted.

Income and Wages: A portion of your payment may be garnished to satisfy a judgment.

Valuables: Expensive possessions such as jewelry, art, or valuable collections may be at risk.

Understanding the potential risk to your assets is crucial, and being proactive can make a significant difference in protecting what matters most to you.

Can I lose my house due to an at-fault car accident in Nevada?

No, generally, your house cannot be directly seized due to a car accident in Nevada. However, if the damages from the accident exceed your insurance coverage, you may be personally responsible for the remaining costs. In such cases, your assets, including your house, could be at risk if a lawsuit is filed against you. It’s crucial to have sufficient insurance coverage to protect your assets.

How to Protect Your Assets After a Car Accident

While the idea of losing your house due to a car accident is undoubtedly distressing, there are measures you can take to safeguard your assets:

Purchase Additional Liability Coverage: Consider increasing your liability coverage beyond the state-mandated minimums. This extra protection can act as a financial buffer in a severe accident.

Explore Umbrella Insurance: Umbrella insurance provides an additional layer of liability coverage that goes beyond the limits of your standard auto insurance policy. It can be a cost-effective way to enhance your overall protection.

Separate Personal and Business Assets: If you own a business, keeping personal and business assets separate can provide an added layer of protection in case of a lawsuit.

Consult with an Experienced Attorney: Seeking legal advice is crucial, especially if you’re facing the prospect of a lawsuit. An experienced personal injury attorney can guide you through the legal process and help protect your interests.

Negotiate a Settlement: If you’re facing a lawsuit, exploring the possibility of negotiating a settlement can be a way to avoid the lengthy and costly legal process. Your attorney can help assess the viability of this option.

Minimum Nevada Liability Insurance Requirements

In Nevada, the minimum liability insurance requirements for private passenger vehicles are as follows:

$25,000 for bodily injury or death of one person in any one accident

$50,000 for bodily injury or death of two or more persons in any one accident

$20,000 for injury to or destruction of property of others in any one accident

While meeting these minimums is a legal obligation, it’s essential to recognize that they might not provide adequate coverage in the case of a significant accident. Therefore, understanding your specific needs and considering additional ranges are necessary.

Is Liability Coverage Enough to Cover an Auto Accident?

While liability coverage is a fundamental aspect of auto insurance, its adequacy depends on various factors, including the severity of the accident and the resulting damages. The minimum liability coverage may fall short in significant injuries, extensive property damage, or multiple parties involved.

It’s essential to assess your circumstances and consider whether additional coverage, such as umbrella insurance, is necessary to provide a more robust financial safety net.

The Role of a Personal Injury Attorney

An attorney can play a crucial role in helping individuals navigate the complexities of a car accident, especially when they are an at-fault driver and face the potential risk of losing personal assets. Here are several ways in which an attorney can provide invaluable assistance:

Case Evaluation:

An experienced personal injury attorney can assess the specifics of your case, including the extent of liability, the severity of injuries, and potential damages. This evaluation helps determine the best course of action to protect the interests of accident victims.

Dealing with Insurance Companies:

Attorneys are skilled negotiators who can communicate with insurance companies on your behalf. They can navigate the claims process, ensuring your rights are protected and you receive fair compensation.

Guidance on Asset Protection:

Attorneys can provide advice on strategies to protect your assets. This may include recommendations on insurance coverage, structuring your investments to minimize risk, and exploring legal avenues to safeguard your property.

Explaining Legal Obligations:

Attorneys can help you understand your legal obligations and responsibilities after a car accident. This includes guidance on admitting fault, communicating with other parties involved, and complying with legal procedures.

Navigating Complex Laws:

Car accident cases involve a complex web of laws and regulations. Attorneys have the legal expertise to navigate these complexities, ensuring you understand your rights and obligations.

Documentation and Evidence Gathering:

Attorneys can assist in gathering and preserving evidence related to the accident. This includes accident reports, witness statements, medical records of an accident victim, and other documentation that may be crucial to building a solid defense.

Maximizing Compensation:

In the event of a personal injury lawsuit, an attorney will work to maximize your chances of a favorable outcome. This includes seeking fair compensation for damages, such as medical bills, property damage, and other losses.

Connect with BLG to Protect Your Assets

While the fear of losing your house due to an at-fault car accident is understandable, taking proactive steps can significantly mitigate this risk. Understanding your insurance coverage, exploring additional protection options, and seeking legal team guidance are all essential to safeguarding your assets after a car accident.

Accidents happen, and the legal system is designed to address these situations fairly. By being informed and taking the necessary precautions, you can navigate the aftermath of an at-fault car accident with greater confidence and protect what matters most to you.

If you find yourself grappling with the aftermath of an at-fault car accident and are concerned about the potential impact on your assets, the legal team at BLG is here to help. Our experienced personal injury attorneys specialize in navigating the complexities of car accident cases in Nevada.

Contact BLG for a free case evaluation.

FAQs

How many points is an at-fault accident?

The number of points assigned for an at-fault accident varies by state and insurance company policies. In some states, the Department of Motor Vehicles may assign points to your driving record, affecting your insurance rates. The specific point system can vary, so checking your state’s regulations and insurance provider’s policies is essential.

How long does an at-fault accident stay on your record?

The duration of an at-fault accident on your driving record varies by state and insurance company. Generally, it can range from three to five years. During this time, the accident may impact your insurance premiums. After the specified period, the accident is typically removed from your driving record, and your insurance rates may gradually decrease.

What happens if you are at fault in a car accident?

If you are at fault in a car accident, you may be liable for damages to the other party. Your insurance company will likely cover the costs up to the limits of your policy. However, you may be personally liable if the damages exceed your coverage. Being at fault can also increase insurance premiums and points on your driving record, affecting future insurance rates.

Is accident forgiveness available?

Accident forgiveness is a feature some insurance companies offer that protects your premium from increasing after your first at-fault accident. It is only automatically included in some policies and may need to be added as optional coverage. Eligibility criteria and availability vary among insurance providers, so you must check with your insurer to determine if accident forgiveness is an option for you.